Market Update | 2025 Year End

A Year Defined by Patience, Adjustment, and Opportunity

“North Van: Sales declined 7.8% while new listings rose 13.1%, pushing detached median values down 4.3%.

West Van: Sales fell 12.2% year-over-year, maintaining a buyer-advantaged environment with detached values holding relatively flat (▼ 0.5%).

Bottom Line: The market has shifted from urgency to selectivity. 2026 will reward patience and precision over speed.”

2025 was a year of measured activity across the North Shore real estate market. Sales softened in both North and West Vancouver, reflecting a cautious buyer mindset and a market adjusting to elevated inventory and shifting economic conditions.

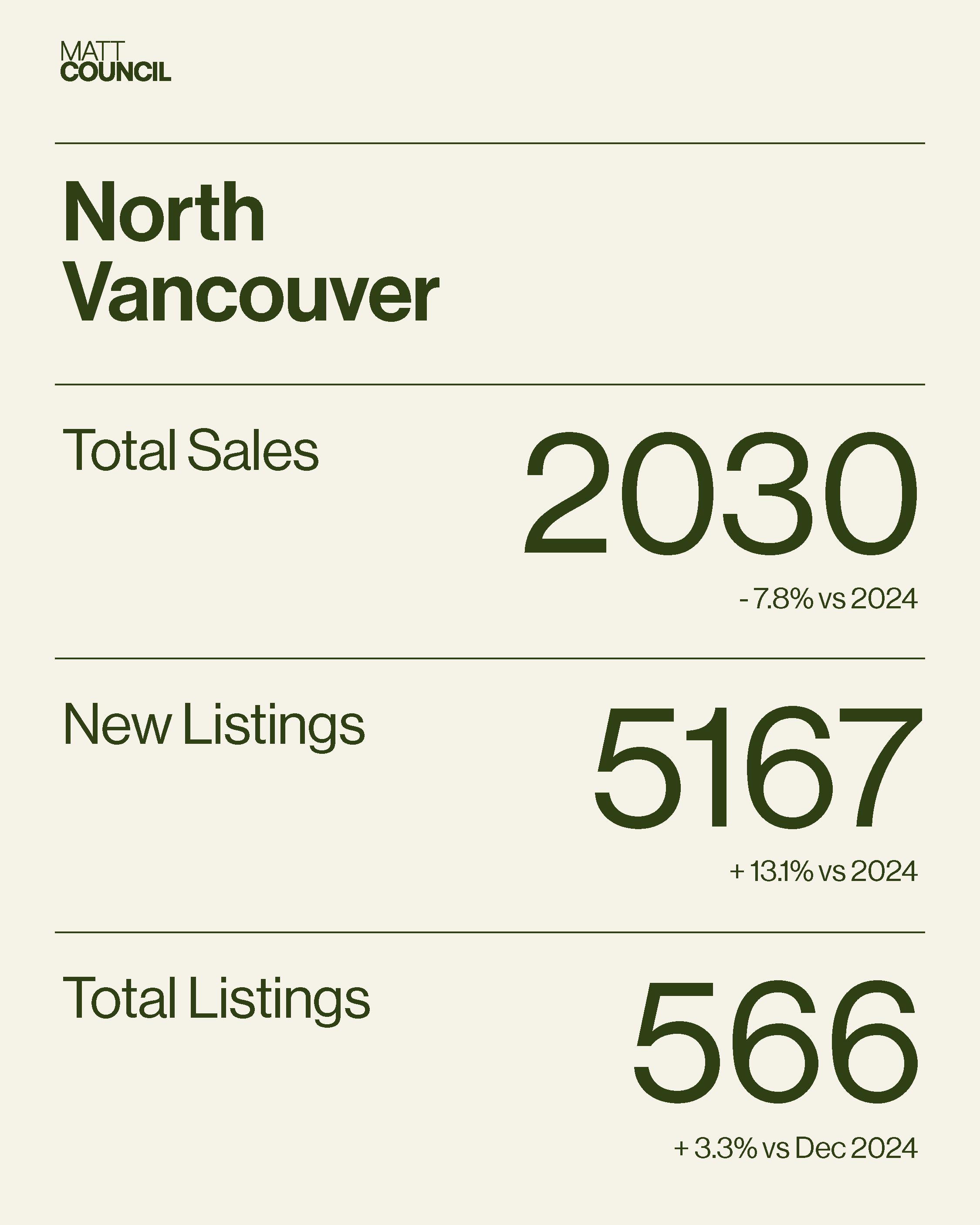

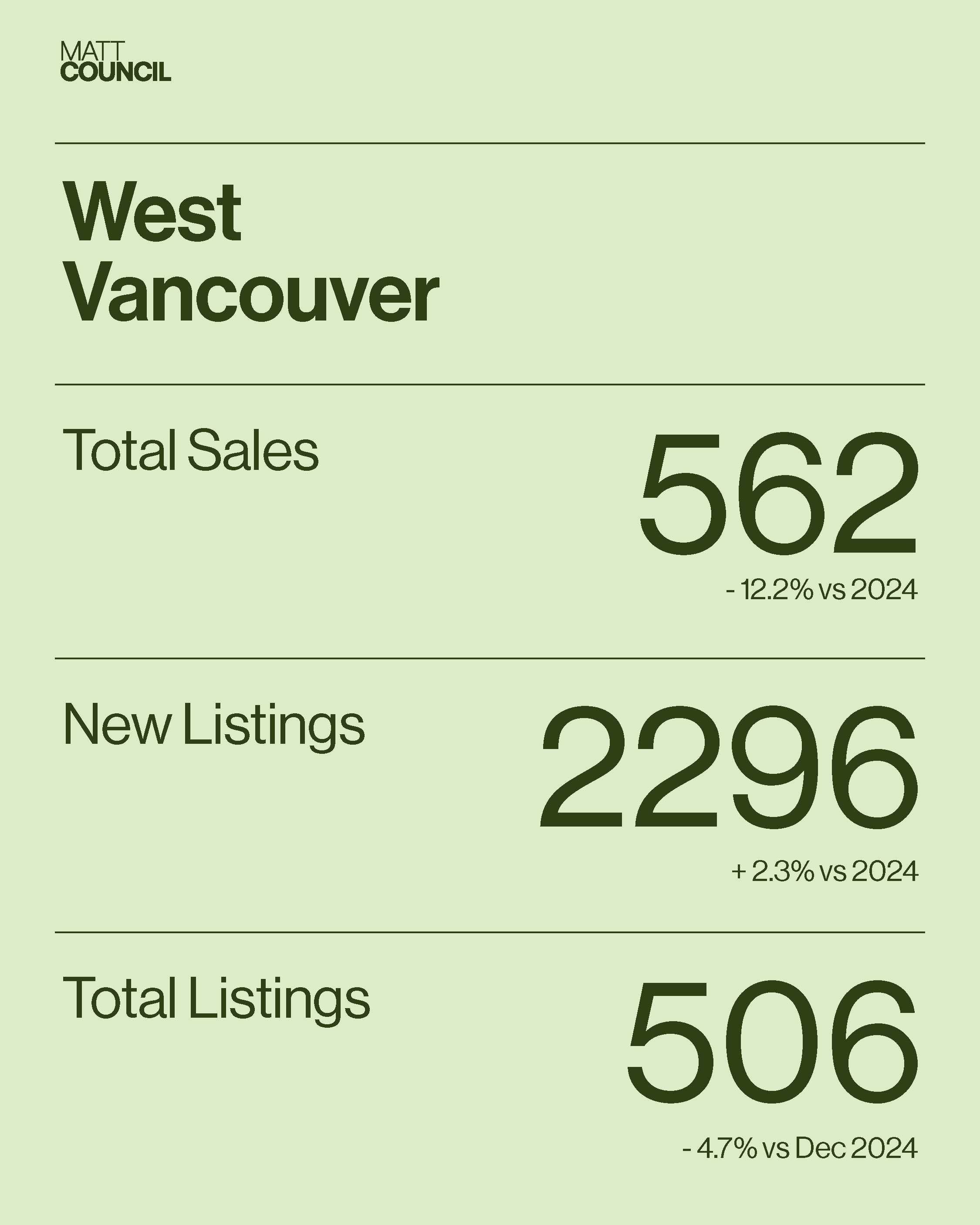

In North Vancouver, 2,030 homes sold over the year, down 7.8% from 2024 and roughly 22% below the 10-year average. West Vancouver recorded 562 sales, a 12.2% decline year-over-year and approximately 31% below its long-term average. While activity levels were lower, the market remained active, particularly for well-positioned properties.

Inventory Up, Demand More Selective

Listing activity remained elevated throughout much of the year. New listings in North Vancouver increased 13.1% year-over-year, while West Vancouver saw a more modest 2.3% rise. This combination of softer demand and increased supply shaped the overall tone of the market.

Despite declining interest rates and improved borrowing conditions later in the year, buyer behaviour remained cautious. Many purchasers took a deliberate approach, prioritizing value and timing over urgency. For sellers, this translated into longer selling timelines and negotiations that were more detailed and strategic than in previous years.

Segment Trends: Detached Homes Lead Activity

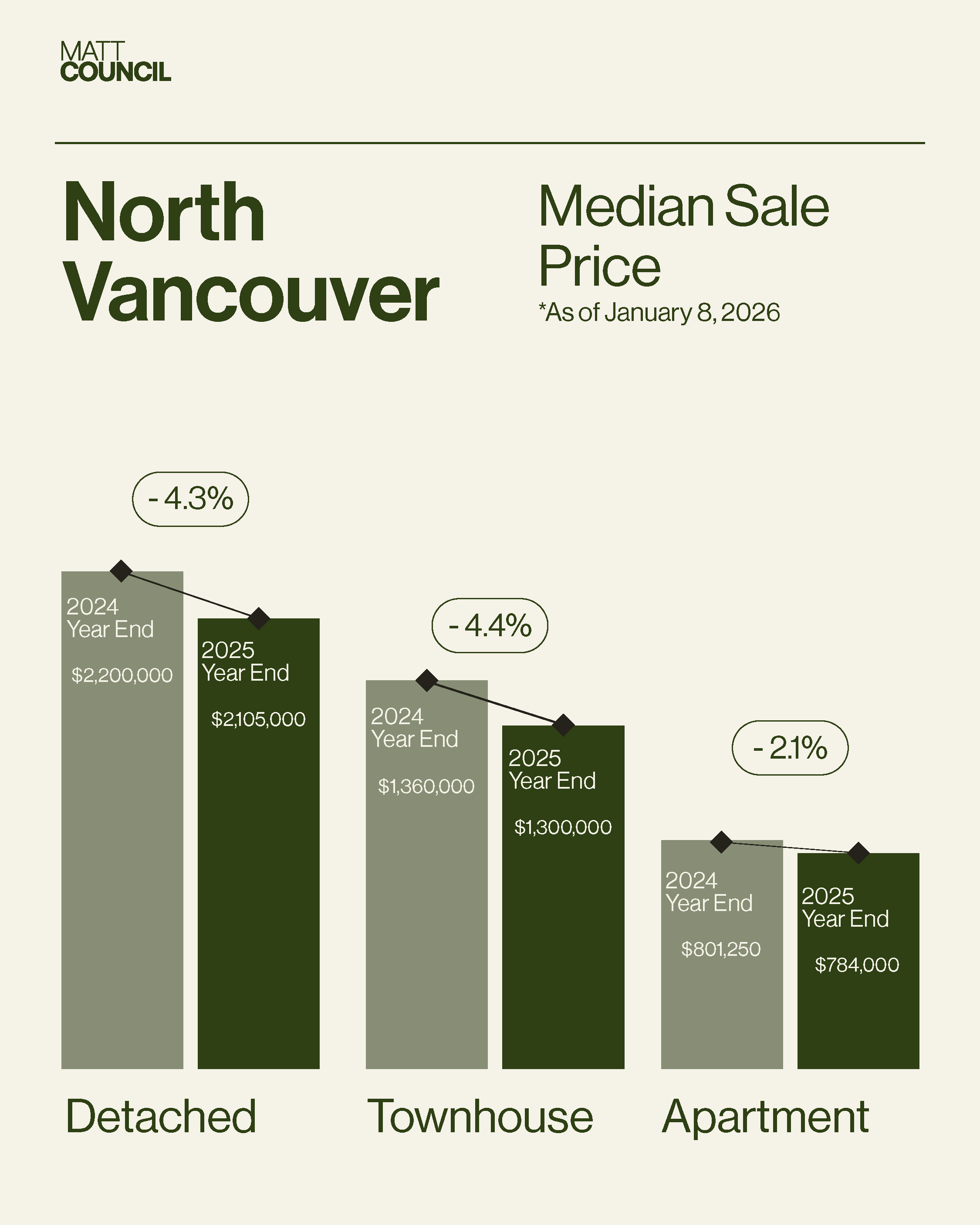

Market dynamics varied by property type. Detached homes continued to drive the majority of activity, with pricing adjustments opening opportunities for buyers who had previously been priced out of the market. As a result, some demand shifted toward single-family properties.

Condos and townhomes, by contrast, experienced slower movement. With more choice available and buyers able to stretch into larger or more desirable homes, these segments faced a more selective pool of purchasers. Across all property types, prices trended lower over the year, reflecting the combined effects of elevated inventory, cautious buyer sentiment, and broader economic uncertainty.

Seasonal Patterns Held Firm

Seasonality played a familiar role in shaping the market. Activity peaked in the spring, eased through the summer months, and slowed further as fall and the holiday season approached. Inventory reached its highest point in early summer before tapering toward year-end, largely due to seasonal pauses rather than a structural shift in supply.

Buyers remained patient throughout, taking time to assess options rather than responding to short-term momentum. This steady rhythm defined much of the year.

Looking Ahead to 2026

As we move into 2026, the North Shore market presents opportunities on both sides. Inventory remains elevated, prices have moderated, and borrowing costs are lower than they were a year ago.

For buyers, this environment offers more choice and favourable conditions than in recent years. For sellers, success will continue to depend on thoughtful pricing, strong presentation, and an understanding that outcomes are increasingly property-specific.

If current trends persist, 2026 is likely to reward careful preparation and informed decision-making, rather than speed or speculation.

2025 North Shore Values

North Vancouver

Median single-family home price: $2,105,000, down 4.3%

Median condo price: $785,000, down 1.9%

Median attached home price (townhomes and half-duplexes): $1,365,000, down 3.9%

West Vancouver

Median single-family home price: $2,950,000, down 0.5%

Median condo price: $1,195,000, down 2.0%

Median attached home price (townhomes and half-duplexes): $1,854,000, down 21.5%

BC Assessment Update

The 2026 BC Assessments are now available, reflecting values as of July 1, 2025. On average:

Single-family homes in the City and District of North Vancouver declined 3%

Single-family homes in the District of West Vancouver declined 5%

Strata properties across all three municipalities declined 2%

If you have questions about your assessment or would like sales data to support a potential appeal, we’re happy to help.